Get Started With

servzone

Overview

Non-banking financial company (NBFC) is a type of financial institution that provides financial services to individuals as well as business entities. This type of financial services is similar to banks, but it does not require banking license but such company owns NBFC license. NBFCs act as an alternative to banks as they provide financial solutions to the unorganized segment of the society.

Regulated Authority of NBFCThe Reserve Bank of India (RBI) formulates rules and regulations; Regulations for NBFCs therefore require a license to introduce NBFCs in India, as per Section 45-IA of the Reserve Bank of India Act, 1934, RBI is authorized to regulate NBFCs. Ensure that they are in compliance with the prescribed rules. & Amp; Rules.

Principal Business Requirement for NBFCNBFC's core business is to provide financial services, including loans, shares, bonds, debentures, leasing, hire purchase, P2P market place lending business, financial information services provider (NBFC-AA) insurance business and Receiving Deposit under any scheme or arrangement.

Further, to continue with the NBFC license, the following conditions must be met:

- Financial assets comprise more than 50% of total assets

- More than 50% of gross income should be generated from financial income

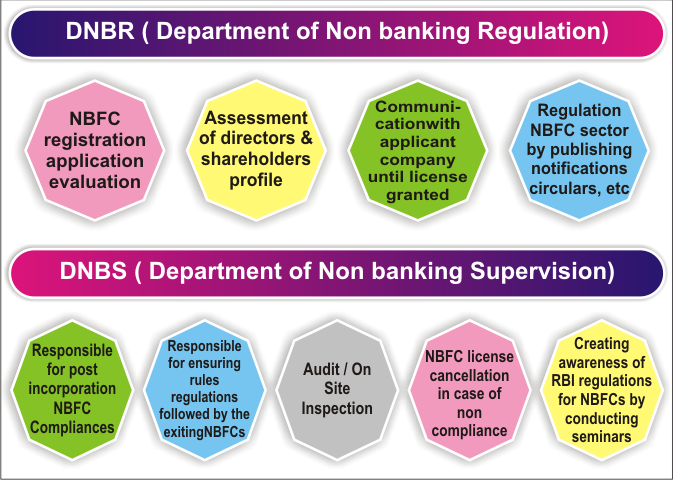

To regulate & supervise functions of NBFC, RBI has two departments which are as follows:

- Agricultural Activity

- Industrial Activity

- Sale / purchase of goods and services

- Sale / purchase of real estate construction

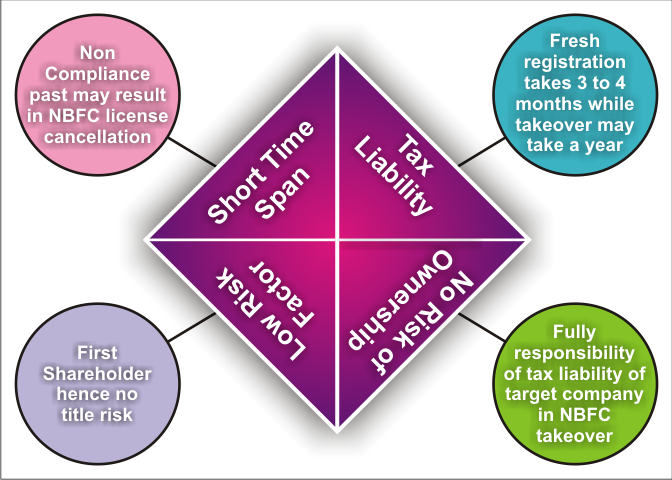

Another way to start a finance business is to acquire an existing NBFC, but it is always advisable to go for NBFC registration.

Now, you may be wondering why?

Types of NBFCs

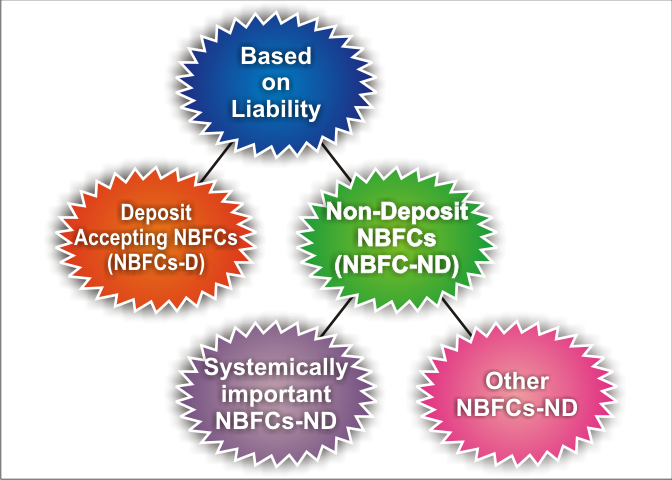

NBFC is classified into two types:

All NBFCs – ND whose asset size is Rs. 500 Crore and more as per the last audited balance sheet is considered as Systemically Important NBFC (NBFC-ND-SI).

Asset size of the group companies to be clubbed

NBFC-ND-SI has to follow the policies prescribed by RBI mandatorily and exempt from Credit Concentration Norms.

NBFC-ND-Non SI is exempt from observing Prudential Norms, 2015 (except Annual Certificate)

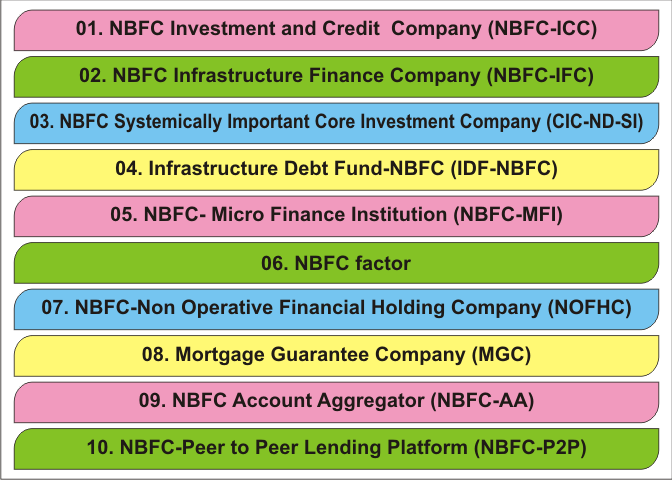

On The Basis Of Activities

- NBFC-Investment and Credit Company (NBFC-ICC)

It is a type of NBFC that deals with lending and investment activities. The first three categories were later merged into one to provide greater operational flexibility.

[asset finance company + loan company + investment company = investment and credit company]

- NBFC-Infrastructure Finance Company (NBFC-IFC)

These types of financial institutions are mainly engaged in providing infrastructure loans.

- NBFC-Systematically Important Core Investment Company (CIC-ND-SI)

Its activities mainly involve equity shares, preference shares, loans or loans of group companies.

- Infrastructure Debt Fund-NBFC (IDF-NBFC)

The activities of NBFC-IDF mainly relate to facilitating long-term debt flow in infrastructure projects.

- NBFC-Micro Finance Institution (NBFC-MFI)

NBFC-MFI has been constituted mainly to provide loans to economically disadvantaged groups.

- NBFC-Factor

Their main activity relates to the acquisition of an assignee or receivable of loans receivable against the security interest of the receivable at a discount.

- NBFC-Non-Operative Financial Holding Company (NOFHC)

Facility of promoters / promoter groups in setting up new banks

- Mortgage Guarantee Company (MGC)

Undertaking mortgage guarantee business

- NBFC-Account Aggregator (NBFC-AA)

Collecting and providing information about a customer’s financial assets in a consolidated, organized and retrievable manner to the customer or others as specified by the customer.

- NBFC–Peer to Peer Lending Platform (NBFC-P2P)

It provides an online platform to help lenders and borrowers raise funds

Different between NBFC and bank

We can differentiate NBFCs from banks based on the following points:

- Earth

NBFC banks provide banking services to people without obtaining a license.

The bank is a government authorized financial intermediary, which aims to provide banking services to the public.

- Regulated Authority

In case of NBFCs - Companies Act 2013 & RBI Act, 1934

In case of banks - Banking Regulation Act 1949

- Demand Deposit

NBFC cannot accept demand deposit.

Banks can accept demand deposits.

- Foreign Investment

In case of NBFCs, foreign investment is allowed 100%.

Foreign investment up to 74% is allowed for private sector banks.

- Payment and Settlement Systems

NBFCs – not a part of system

Banks – Integral part of the system

- Maintenance of Reserve Ratios

is not required in case of NBFC.

Banks have to maintain reserve ratio.

- Submit insurance facility

NBFCs – Not available

Banks – Available

- Credit Creation

NBFCs do not create credits.

Banks create credit.

- Transaction Services

NBFC cannot provide transaction services.

Banks provide transaction services.

Importance & Functions

NBFC registration is very important for a person who wants to do finance business in India. NBFCs cater to a wide range of customers and provide loans to underprivileged sections of society including both urban & amp; Thus rural areas contribute to the development of the country. Further, the interest rate at which an NBFC advance loan can be fixed keeping in mind the RBI guidelines.

The functions of NBFC are as follows:

- Providing customized loan solutions

- Digital platform for lending using advanced technology

- Fast loan processing

- Job creation

- wealth creation

- Infrastructure Development

- Thus financial assistance to the economically weaker section of the society for economic development

Required Documents

- Certified copy of COI (certificate of incorporation) / MOA / AOA

- Net Worth Certificate of Directors, Shareholders & Company

- Educational qualification documents of the proposed directors

- Highest Experience certificates

- Directors & Shareholders business profile

- Credit report of directors & shareholders

- KYC details, PAN of the company, GST number, address proof of the company

- Company's bank account statement [Rs. 2 Cr must be deposited as NOF]

- Audited balance sheet of last 3 years or from date of incorporation

- Related Party Disclosure

- Income Tax Return

- Banker’s Report confirming no lien on fixed deposit

- Format of board proposal regarding NBFC registration

- Underwriting Model - Detailed Action Plan for next 5 years including Fair Practice Code and Risk Assessment Policy

- Business Structure & Loan Structure

- IT Policy

FDI

100% FDI is permitted under the automatic route for NBFCs, if NBFC is engaged in the following subject to minimum capitalization requirements:

- Merchant Banking

- Underwriting

- Portfolio Management Services

- Investment Advisory Services

- Financial Consulting

- Stock Broking

- Asset Management

- Venture Capital

- Custodian Services

- factoring

- Credit Rating Agencies

- Leasing & Finance * (Financial Leasing Only)

- Housing Finance

- Forex Broking

- Credit Card Business **

- Changing Money Business

- Micro Credit

- Rural Credit

Opportunities

The business environment in India is favorable to NBFC for its expansion. The Reserve Bank of India heavily controls the financing business in India. A registered NBFC helps in gaining the trust of borrowers, securing the capital invested in the business.

Therefore, NBFC registration offers many benefits.

- Lowest Business and Legal Risk

- High customer confidence after grant of NBFC license

- Easy to increase investment in NBFC

- Access to CIBIL and other credit bureau data

- Open Interest Rate

- Free to charge Processing Fees–

- Protection by law for recovery of debt

- Easy Bank Finance

- up to 100% permitted by FDI

- Leverage technology and low operating costs

- Decline in bad debts due to credit reporting to the bureau

Pre-requisites

For NBFC registration, the following conditions must be fulfilled as per Section 45-IA of the RBI Act, 1934:

- Company Registration

An applicant must be a company registered under the Companies Act 1956 or Companies Act 2013.

- Director’s Experience

1/3 rd The directors of the applicant company must have experience in the finance sector to apply for an NBFC license.

- Five Year Business Plan

An applicant company will have to draft a detailed business plan for the next five years. And

Applicant company should have minimum NOF of Rs. 2 crores. Tax will have to be paid on this.

RBI checks the quality of the prescribed capital to ensure that the invested capital does not comply with the prescribed laws for free.

The credit score of the company, directors & its shareholders must be fineand they must have not defaulted loan re-payment deliberately to banks or to NBFCs.

An applicant company must comply with mandatory compliance.

In case of foreign investment participation, an applicant company should comply with FEMA Act Act. 100% FDI is allowed from FATF member countries.

Advantages of NBFC registration

Registration process

Follow the steps given below to set up your NBFC:

RBI conditions for grant of NBFC license

Market Size

NBFCis is considered as a fast growing business. In India, there are many banks, however, some areas are still untouched, and there are no banking facilities available, resulting in increased demand for loans from NBFCs and ultimately higher numbers of NBFC registrations. NBFC incorporation has taken a leap in the last few years and is playing a very important role in the development of the financial sector. The main reason behind this is to provide customized loan products, customer friendly loan policy as well as fast processing of loans, advanced technology and digital access.

Non-banking financial companies (NBFCs) have succeeded in attracting considerable market share in banking and banking-related services. NBFCs are engaged in the same business as a bank but do not cover everything that is involved in a bank. NBFCs can raise money directly or indirectly from the public, and can freely lend them to the ultimate spenders.

In our opinion, the NBFC sector will make steady progress because of the advanced technology used by financial companies regardless of the slow growth rate. / />

Cancellation

RBI can cancel the NBFC license on the following grounds:

Mandatory complaints

Formalities before starting a business

After obtaining registration but before starting business, there are following types of complaints, which need to be followed for further operation.

NBFC will have to apply for the following:

NBFC Annual Complaints

After compliance with the above registration, NBFC will have to follow the compliance mentioned on annual basis:

Penalty

1 to 5 years imprisonment and A fine of Rs. 1 to 5 lakhs Rs.

imprisonment for 3 years

Penalty which may extend to Rs. 2000 per offense and in case of continuous non-compliance, an additional fine of up to Rs. 100 per day from first offense

imprisonment for 3 years and Fine twice the amount received

Servzone Process

Servzone helps some other services

- Minimum NOF (Net Ownership Fund) requirement

- Qualify Capital Test

- Credit History

- Capital Quality

- FEMA complaints

- Experience an NBFC Registration Advisor at least 10 years old’s Experience and having a team of experienced professionals like CA, CS, Lawyers and Senior Bankers.

- The proposed name of the company should include Finance, FinServ, Finals, Investment, Capital, Fintech and Leasing etc.

- Register a private limited or public company

- Plan your registered office, city and area of ​​operation

- Get a certificate of incorporation from the Registrar of Companies

- Net owned funds deposited in the bank account opened for the company

- Documentation for obtaining NBFC license

- Drafting of business plan for next 5 years:

- • Executive Summary

- • Product Plan

- • Lending Model

- • Risk Model

- • Peer Analysis

- • SWOT Analysis

- • Financial Projections

- Apply for registration with RBI under RBI Act, 1934.

- The applicant company has to make an online application with RBI on its official website.

- Subsequently, an applicant will get a reference number (CARN) to facilitate future investigations.

- After this, duplicate hard copies have to be submitted to the concerned Regional Office of RBI.

- The regional office will check the accuracy of all submitted documents.

- The regional office will send the application for NBFC registration to the central office.

- The central office of the RBI provides NBFC registration only when the applicant company meets the requirements laid down under Section 45-IA .

- NBFC should start its business within 6 months from the date of registration certificate

- After applying for NBFC registration, RBI will check the file and grant license only after fulfilling the below mentioned conditions:

- The ability of NBFCs to meet their dues for investors and the company's business plan is to serve the larger interest of society.

- NBFC activities will not be harmful to the public interest at large

- Ability to influence sufficient capital

- Acquisition potential of the proposed business

- The activities will be done in such a way that it is in the public interest

- The board will act in the interest of the public or the depositors

- Grant license will contribute to the economic development of the country

- Proposed NBFC will follow RBI rules

- NBFC license can be cancelled in case of insufficient financial experience

- Directors & shareholders business profile is not satisfactory

- Not up to the business plan mark

- Arrangement of capital from prohibited sources

- NBFC Advisors Not Experienced

- The field of NBFC operations is not encouraging

- Registration with 4 Credit Rating Agencies – CIBIL, ICRA, Equifax and Experian

- Central KYC

- CERSAI Registration

- FIU-IND Registration

- Adopting Fair Practice Code

- National e-Governance Registration

- Adoption of Anti Money Laundering Policy & IT Policy

- Submission of Financial Information to Information Utilities

- Filing of annual returns with RBI

- Statutory compliances with the registrar of companies (ROC) – Annual Return Filing, Filing of Financial Statements

- Tax Filing - Income Tax Returns & GST Returns

- Doing NBFC activities without CoR

- Not complying with RBI instructions

- Failure to build documentation or answer questions

- Acceptance of deposits

- First, you have to fill in the query form

- You will get a call from our expert

- Pay

- Get Confirmation on Mail

- Presentation of documents with us

- Executive will process your application

- Track progress of your order

- Order Fulfilled

- Fintech Based Lending Model Advisor

- Designing loan product & documentation

- complete market strategy

- Assistance in fund raising

- Virtual CFO Services

- Post incorporation compliance

- Expert Advisor on adoption of Ind-AS and IFRS

GST Registration

PVT. LTD. Company

Loan

Insurance